The Economic Case for Climate Finance at Scale

Patrick Bolton, Alissa M. Kleinnijenhuis & Jeromin Zettlemeyer (2024)

Paper

Media: Financial Times (Martin Wolf), Financial Times (Editorial), Politico (Sustainability Insights, June 11 2024), L’Opinion, Capital (Türkiye), Carbon Brief

Blogs: European Corporate Governance Institute (ECGI), Encompass Europe

Abstract

It will be impossible to contain the global temperature rise to 1.5 to 2 degrees Celsius above pre-industrial levels unless emerging market and developing economies (EMDEs) decarbonise much more rapidly. This policy brief examines the economic case for advanced-country financial support for replacement of coal with renewable energy sources in EMDEs. Such conditional financial support is necessary in the sense that an exit from coal consistent with keeping the global temperature rise to between 1.5°C and 2°C will not happen without it, desirable from the perspective of the financier countries, and financially feasible.

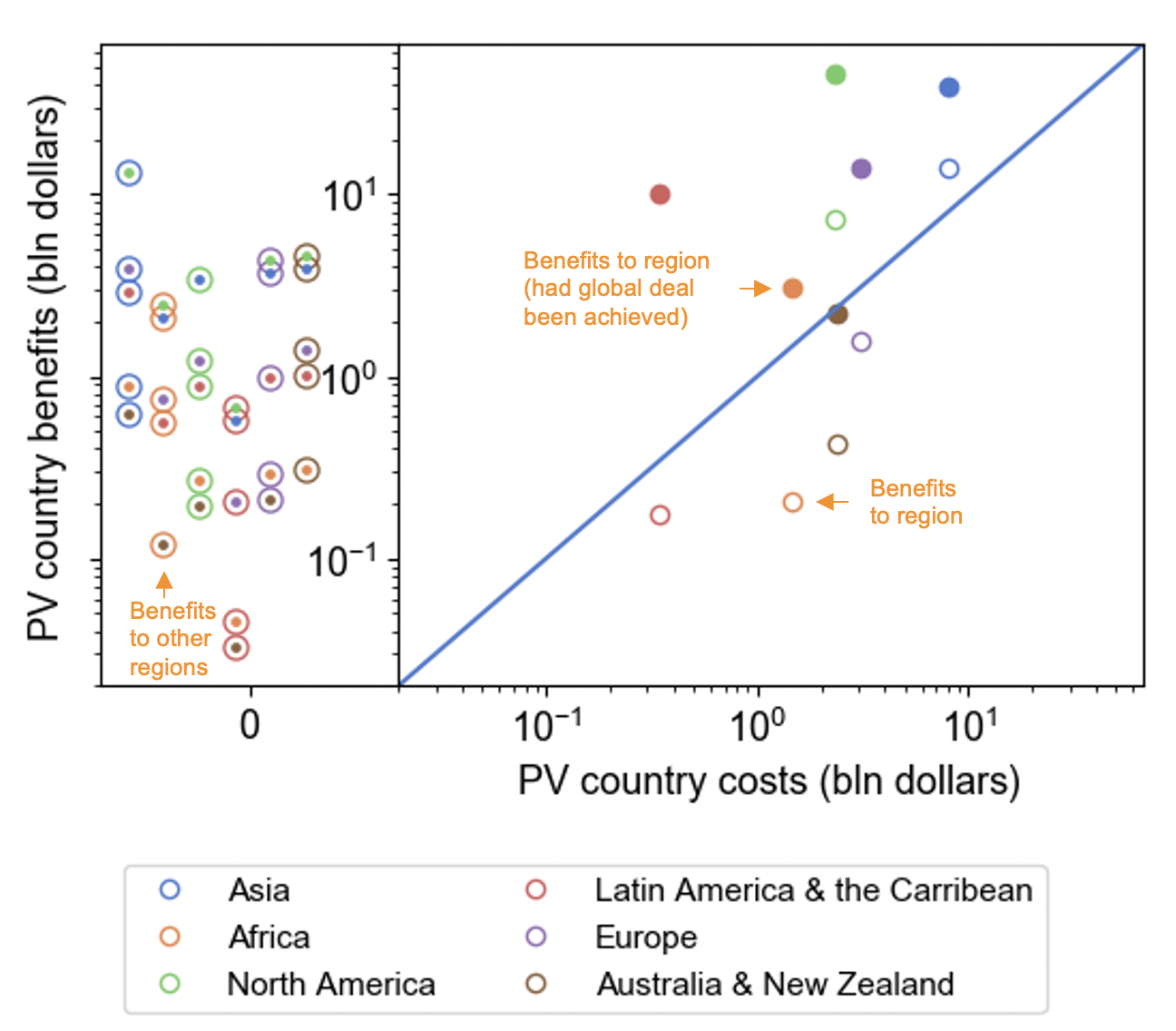

Although the global economic benefits of phasing out coal are very large, the costs of exiting coal generally exceed the benefits to EMDEs. However, the collective economic benefits to advanced countries greatly exceed those costs. These net benefits are positive even for small coalitions of advanced countries (G7 or G7 plus EU). The fiscal costs of financing the coal exit in EMDEs (without China) are modest as a share of G7+EU GDP at about 0.3 percent of GDP per year, assuming public-sector participation in renewable energy investment costs through blended finance of around 25 percent.

Although providing climate finance to EMDEs is economically desirable and feasible from the G7 perspective, it is not happening at the necessary scale, partly because of incentives and political-economy challenges. Advanced countries are more likely to be willing to commit financing to climate action outside their borders if they have more control over how this money is spent. Developing countries are reluctant to phase out coal unless sufficiently large financial support is forthcoming for renewable investments that are consistent with their development goals.

These problems could be overcome by tying renewable finance to a coal phase-out. Already-existing Just Energy Transition Partnerships with South Africa, Indonesia and Vietnam are prototypes of this approach. They should be scaled up, with sufficient grants to pay for coal closures and the social transition in coal communities, by explicitly conditioning funding on a coal phase-out and through a stronger governance structure to implement these deals.

The Great Carbon Arbitrage

Tobias Adrian, Patrick Bolton & Alissa M. Kleinnijenhuis (2022)

Paper

Review of Financial Studies, Under Review

CEPR Working Paper, IMF Working Paper

Website of paper: https://greatcarbonarbitrage.com

Media: Financial Times (Gillian Tett), Financial Times (Editorial), Trouw (front page), Trouw (big read), NRC (big read), IMF Market Insights, Insights ESG, Axios, Tagespiegel, Grist, Business Traffic, CEPR (special mention), and many more see.

Podcast: VoxEU

Blogs: VoxEU, VoxEU 2, SUERF, SIEPR Stanford University, IMFBlog, INET University of Oxford, Imperial College London

Presentations (a selection): Corporate Carbon Disclosures Conference, Stanford Graduate School of Business & Stanford Doerr School of Sustainability; Federal Reserve Board of Governors; Chief Economist Research Seminar Series, The World Bank Group*; 2022 YISF Annual Symposium: The Parallel Pressures of Sustainable Finance, Yale Center for Business and the Environment, Yale University; Finance and Environmental Sustainability Conference, Stanford Graduate School of Business & Stanford Doerr School of Sustainability; The Political Economy of Environmental Sustainability Conference, Stanford Graduate School of Business & Stanford Doerr School of Sustainability; Roundtable on Blended Concessional Finance in Climate Investing, King Philanthropies and the International Finance Corporation, King Center on Global Development, Stanford University; Workshop on Fiscal Policy and Climate Change, European Central Bank; Office of Financial Research Conference, Climate Risks & Financial Stability; Keynote, 2022 Cornell University ESG Investing Research Conference, Cornell University’s SC Johnson College of Business; Keynote, Sustainable Global Capital Conference*; Office of the Comptroller of the Currency; World Resources Institute; Climate Policy Initiative; Fidelity Investments; International Monetary Fund; Institute for New Economic Thinking at the Oxford Martin School; De Nederlandsche Bank; Universiteit van Amsterdam; Vrije Universiteit; African Development Bank, European Investment Bank, European Bank for Reconstruction and Development; Banque de France; Bundesbank; Asian Development Bank; Brookings Institution*; New York University; Imperial College London; Bruegel; 13th NYU-LawFin/SAFE - ESCP BS Law & Finance Conference; Bank of Italy; The E-Axis Forum on Climate Change, Macroeconomics and Finance; Climate Finance, Innovation & Challenges for Policy, Stanford Department of Economics & SITE, Stanford University; Caltech; Western Finance Association Meetings; BlackRock.

Abstract

We measure the gains from phasing out coal as the average social cost of carbon times the quantity of avoided emissions. By comparing the present value of benefits from avoided emissions against the present value of costs of ending coal and replacing it with renewables, our conservative baseline estimate is that the world can realize a net gain of $85 trillion. This global net social benefit can be attained through an international agreement to phase out coal. We also explore how this net benefit is distributed across countries and find that most countries would benefit from a global coal phase-out even without any compensatory cross-country transfers. Finally, we estimate the size of public funds that must be committed under a blended finance arrangement to finance the cost of replacing coal with renewables.

Resolving Too Big To Fail: How the Bail-In Design Matters

Alissa M. Kleinnijenhuis & Charles Goodhart (2022)

Abstract

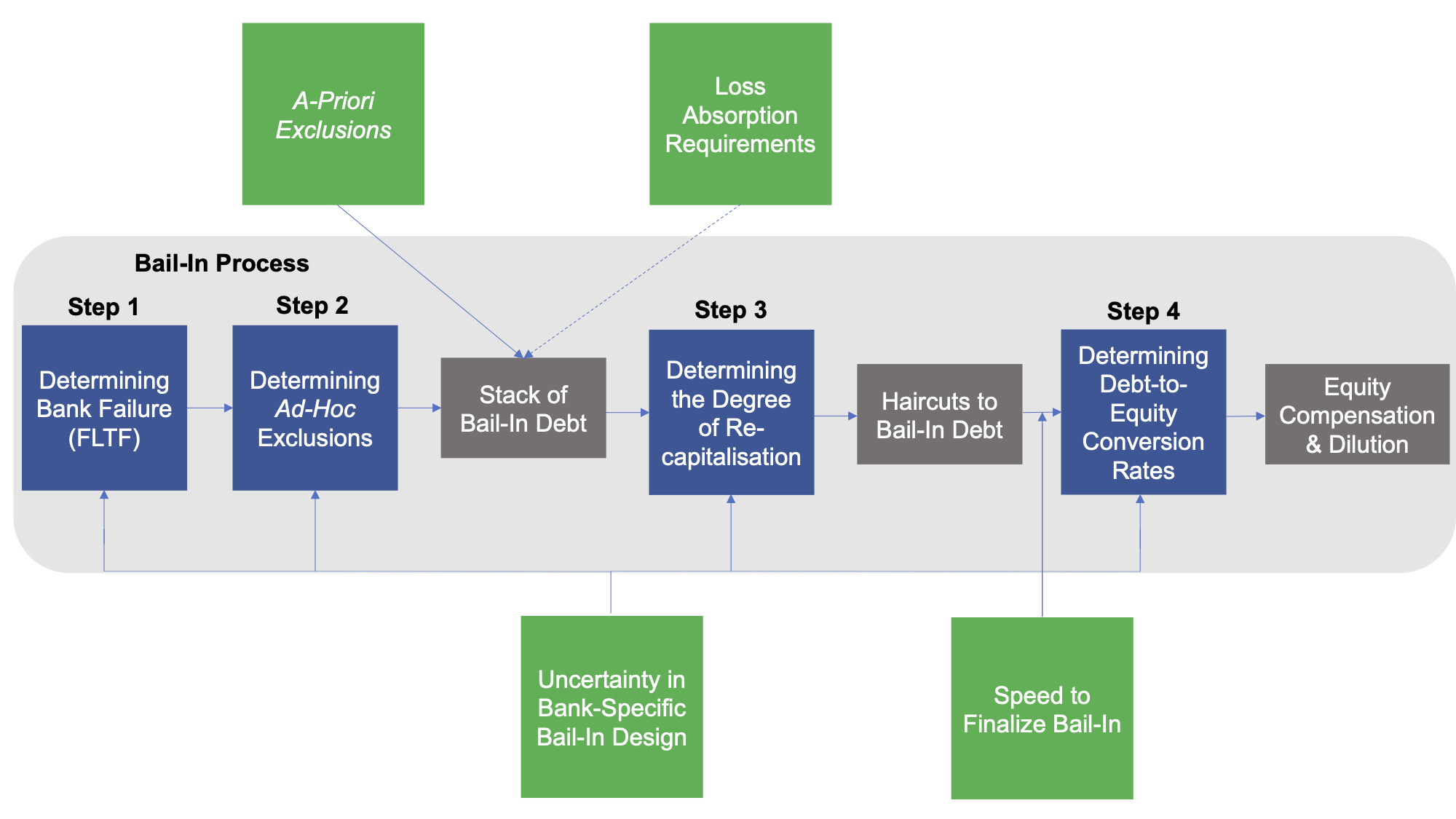

Could bail-in resolve the too big to fail problem? To answer this, we study systemic implications of the bail-in design, capturing the financial system’s networked nature. Our hypothesis that bail-ins are not credible in systemic crises but are credible for idiosyncratic bank failure is partially rejected. We find that the credibility of bail-in hinges on the bail-in design. A well-designed bail-in maintains stability even in severe systemic crises, whereas an ill-designed one exacerbates distress, also when the largest banks fail idiosyncratically. The current bail-in design creates instability. While policy makers can fix this, the political economy incentives make this unlikely.

Higher-Order Exposures

Esti Kemp, Alissa M. Kleinnijenhuis, Thom Wetzer & Garbrand Wiersema (2021)

Abstract

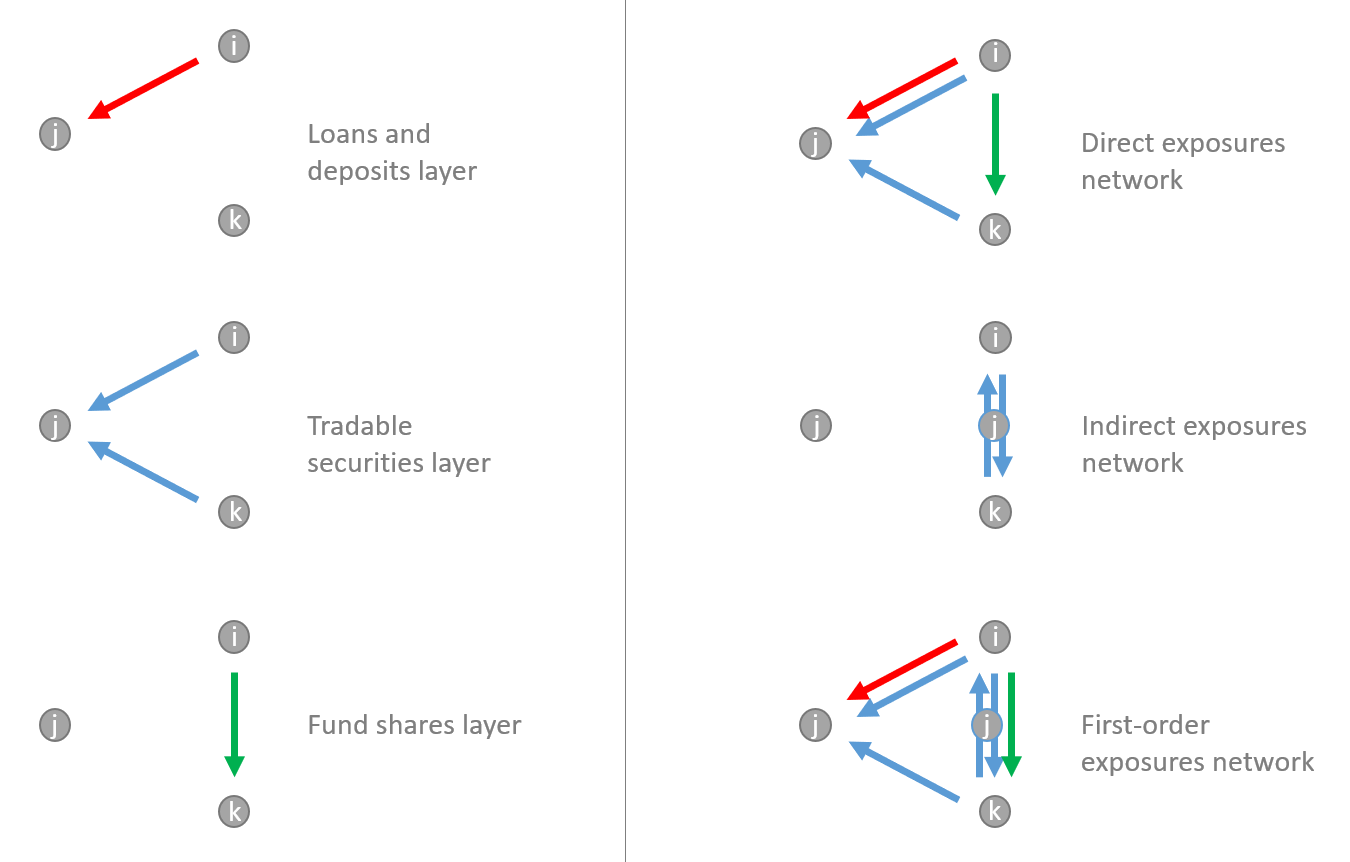

Traditional exposure measures focus on direct exposures to evaluate the losses an institution is exposed to upon the default of a counterparty. Since the Global Financial Crisis of '07/'08, the importance of indirect exposures via common asset holdings has been increasingly recognized. Yet direct and indirect exposures do not to capture the losses that result from shock propagation and amplification following the counterparty's default. In this paper, we introduce the concept of ``higher-order exposures'' to refer to these spill-over losses and propose a way to formalize and quantify these. Using granular data of the South African financial system and a contagion model that captures the most commonly studied contagion channels and their interactions, we show that higher-order exposures make up a significant part of exposures – particularly during times of financial distress when exposures matter most. We also show that higher-order exposures cannot simply be extrapolated from direct or indirect exposures, since they depend strongly on the network structure and the robustness of individual institutions. Our findings suggest that higher-order exposures should inform the design and calibration of those tools in the regulators' arsenal where exposures matter — including large exposure limits, capital requirement calibration, stress test design and resolution. Exposures should be properly understood as consisting of the sum of direct, indirect, and higher-order exposures.

Stress Testing the Financial Macrocosm

J. Doyne Farmer, Alissa M. Kleinnijenhuis, Thom Wetzer (2022)

Abstract

What should the next generation of financial stress tests look like? If recent crises are any guide, our strongly interlinked financial system, economy, and indeed wider society need to be viewed in unison – together, they make up a larger ‘financial macrocosm’. Studying the resilience of that larger macrocosm requires a new generation of stress testing models that capture the interconnections within the financial system, between the financial system and the real economy, and – particularly in the context of climate change – the interconnections between the natural world, the real economy, and the financial system. Such models, informed by large-scale data collection, would enable better evaluation of financial stability risks and support the design of new policy ideas to improve financial stability outcomes. In a rapidly evolving financial system that is constantly facing new threats, they would help policymakers and regulators get back into the driver’s seat. We appreciate that this vision is ambitious – the goal of this chapter is to make it plausible and to articulate what it would take to make it real. We introduce the modelling techniques and conceptual framework such an approach would be based on, outline the modelling innovations and the enabling conditions that are required, and conclude with a brief overview of the improvements to financial regulatory policy such stress tests would enable.

Foundations of System-Wide Stress Testing

with Heterogeneous Institutions

J. Doyne Farmer, Alissa M. Kleinnijenhuis, Thom Wetzer & Paul Nahai-Williamnson (2020)

Abstract

We propose a structural framework for the development of system-wide financial stress tests with multiple interacting contagion, amplification channels and heterogeneous financial institutions. This framework conceptualizes financial systems through the lens of five building blocks: financial institutions, contracts, markets, constraints, and behavior. Using this framework, we implement a system-wide stress test for the European financial system. We obtain three key findings. First, the financial system may be stable or unstable for a given microprudential stress test outcome, depending on the system’s shock-amplifying tendency. Second, the “usability” of banks’ capital buffers (the willingness of banks to use buffers to absorb losses) is of great consequence to systemic resilience. Third, there is a risk that the size of capital buffers needed to limit systemic risk could be severely underestimated if calibrated in the absence of system-wide approaches.

Paper

Non-Technical Summary:

INET Oxford Blog | Oxford Business Law Blog | Rebuilding Macroeconomics

Scenario-Free Analysis of Financial Stability

with Interacting Contagion Mechanisms

Garbrand Wiersema, Alissa M. Kleinnijenhuis, Thom Wetzer & J. Doyne Farmer (2023)

Abstract

Financial stress tests that capture multiple interactions between contagion channels are conditional on specific, subjectively-imposed stress scenarios. Eigenvalue-based approaches, in contrast, provide a scenario-independent measure of systemic stability, but so far only handle a single contagion mechanism. We develop an eigenvalue-based approach that brings the best of both worlds, enabling the analysis of multiple interacting contagion channels without the need to impose a subjective stress scenario. Our model captures the solvency-liquidity nexus, which allows us to demonstrate that the instability due to interacting channels can far exceed that of the sum of the individual channels acting in isolation. The framework we develop is flexible and allows for calibration to the microstructure and contagion channels of real financial systems. Building on this framework, we derive an analytic stability criterion in the limit of a large number of institutions that gives the instability threshold as a function of the relative size and intensity of contagion channels. This analytical formula requires comparatively little data to elucidate the mechanisms that drive instability in real financial systems and thus complements the insights gained from traditional stress tests.

Models of Financial Stability and their Application in Stress Tests

Christoph Aymanns, Alissa M. Kleinnijenhuis, Thom Wetzer & J. Doyne Farmer (2018)

Abstract

We review heterogeneous institution models of financial stability and their application in stress tests. In contrast to the mainstream approach, which relies heavily on the rational expectation assumption and focuses on situations where it is possible to compute an equilibrium, this approach typically uses stylized behavioral assumptions and relies more on simulation. This makes it possible to include more actors and more realistic institutional constraints, and to explain phenomena that are driven by out of equilibrium behavior, such as clustered volatility and fat tails. We argue that traditional equilibrium models and agent-driven models are complements rather than substitutes, and review how the interaction between these two approaches has enriched our understanding of systemic financial risk. After presenting a brief summary of key terminology, we review models for leverage and endogenous risk dynamics. We then review the network aspects of systemic risk, including models for the three main channels of contagion: counterparty loss, overlapping portfolios, and funding liquidity. We give an overview of applications to stress testing, including both microprudential and macroprudential stress tests. Finally, we discuss future directions. These include a better understanding of dynamics on networks and interacting channels of contagion, models with learning and limited deductive reasoning that can survive the Lucas critique, and practical applications to risk monitoring using models estimated with the massive data bases currently being assembled by the leading central banks.

Selected Works in Progress

Carbon-Adjusted GDP

(with Tobias Adrian, Patrick Bolton & Moritz Baer)Climate Risk Materiality

(with Tobias Adrian & Viral Acharya)What is Climate Finance?

(with Patrick Bolton, Marcin Kacperczyk)Climate Finance to Decarbonize the Power Sector

(with Moritz Baer)