Contact.

E-mail:

alissa.kleinnijenhuis@imperial.ac.uk

amklein@cornell.edu

Address:

Imperial College Business School

Imperial College London

South Kensington Campus, Exhibition Rd, London SW7 2AZ, United Kingdom

Google Scholar & Social Media:

Alissa M. Kleinnijenhuis is a Visiting Assistant Professor of Finance at the Cornell SC Johnson College of Business at Cornell University and is affiliated with the Imperial College Business School Finance Department of Imperial College London. Kleinnijenhuis is Research Associate at the Institute for New Economic Thinking (INET) at the Oxford Martin School of the University of Oxford, a Non-Resident Fellow at Bruegel (an EU think tank specializing in economics), a RPN Member of Sustainable Finance at the Centre for Economic Policy Research (CEPR), and a Faculty Fellow of the Cornell Atkinson Centre for Sustainability. She taught the first course at Stanford University on Climate Finance. In Fall 2023 and Spring 2024, she teaches the inaugural Climate Finance course at the Cornell SC Johnson College of Business, at Cornell University. The climate finance courses she teaches are offered to undergraduate students, as well as MBA, master, and PhD students. She founded and co-hosts a novel podcast series, VoxTalks Climate Finance, as part of the highly regarded VoxTalks of CEPR, which seeks to play a formative role in covering the debates at the frontiers of the field that will shape the future of finance when it comes to climate.

Alissa actively collaborates with and advises governments, central banks, corporations, think tanks, and international institutions – including the European Central Bank, the Bank of England, the International Monetary Fund, the African Development Bank, and Fidelity Investments. Alissa is the founding editor of the “Handbook of Financial Stress Testing” (Cambridge University Press, 2022), which features contributions by leading scholars, public sector officials, and practitioners on the topic of stress testing, and includes a preface by Timothy Geithner and endorsements by Ben Bernanke and Christine Lagarde. She is also a founding editor of “Elements in Climate Finance,” a novel publishing format of Cambridge University Press, combining features of books and journals. Since 2023, she organizes Young Scholars’ Webinar on Climate Finance and Economics (supported by the E-Axis Forum). Since 2024, she has been a member (part of the steering committee) of a new CEPR program area on Climate and the Environment.

Kleinnijenhuis’ research examines how finance can advance the public good, focusing on leveraging the financial sector for a climate change solution. Her research in her primary area of focus, climate finance, examines how financial incentives can be aligned with limiting climate risks and financing the transition to a carbon-neutral and sustainable economy. Her research is all about making the triangular sectors of finance – the public, private, and academic sectors – work for the green transition. Her second area of expertise concerns financial stability, financial crises, financial stress testing, and financial regulation. Her third area of expertise is asset pricing and mathematical finance; she has also taught courses in these areas at the University of Oxford.

Her recent major work in climate finance, entitled The Great Carbon Arbitrage (see summary), conducts an empirical global study of the costs and benefits of phasing out coal and replacing this with renewables. It offers, as far as we are aware, the first country-level analysis of the net benefits of phasing out coal — using a granular data set of coal production and emissions at the asset level. The paper makes the economic case for climate finance at scale, showing how climate finance could be made in the incentives of the key stakeholders involved (governments, coal communities, and investors). Indeed, to solve a trillion-dollar climate problem, we need a trillion-dollar solution. Getting to scale requires a robust incentive structure. The key idea proposed is to form “blended conditional climate finance deals,” that can cumulatively add up to a global deal to end coal, the most polluting fossil fuel. The work has been covered by major news outlets around the world, including the Financial Times, Trouw (front page), Trouw (big read), NRC (big read), IMF Market Insights, Insights ESG, Axios, Tagespiegel, Grist, and Business Traffic; and has received >50 invitations in less than a year, from highly regarded academic, public, and private institutions, including from multilateral development banks, central banks, asset managers, and academic conferences.

Dr. Kleinnijenhuis holds a BS from Utrecht University in Economics and Mathematics (cum laude), an MSc in Mathematics and Finance from the Imperial College London, and a D.Phil. (Ph.D.) in Mathematical and Computational Finance from the University of Oxford (Mathematics Department). She was a Postdoctoral Fellow at the MIT Sloan School of Management and the MIT Golub Centre for Finance and Policy (GCFP) at the Massachusetts Institute of Technology (MIT), and a Research Scholar at the Stanford Institute of Economic Policy Research (SIEPR) at Stanford University. She held a Visiting Scholar position at Yale University and the University of California Santa Barbara, and worked for Morgan Stanley and Allianz Global Investors.

News

VoxTalks Climate Finance Episode #2: Is there a Market for Biodiversity?

Although the science of flora and fauna is as old as the science of biology, many ascribe the earliest use of the term “biodiversity” to Harvard’s Edward O. Wilson in a conference proceedings volume that he edited and was published in 1988, entitled Biodiversity (Karolyi & Puente, 2023).

In the second episode of VoxTalks Climate Finance, Tim Phillips and I were excited to converse with Professors Caroline Flammer and Johannes Stroebel, two pioneers in climate finance, about the question: Is there a financial market for preserving biodiversity?

Allison Herren Lee Addresses the SEC’s Mandatory Climate Risk Disclosures Proposal

Thursday, October 23, 2023

Article link

It was a great honor to have former Acting Chair and Commissioner of the Securities and Exchange Commission (SEC), Allison Herren Lee, come give a guest lecture in our inaugural Climate Finance course at Cornell University! Her remarks were truly very insightful and highly salient for today's rapid developments on mandatory climate risk disclosures (including, most recently by California).

Life on planet Earth is under siege. We are now in an uncharted territory.

Climate Finance Guest Lecture | Professor Tim Lenton | Tuesday October 31, 2023 | 9am-9:55am EST | Cornell SC Johnson College of Business

Article Link 1, Article Link 2, Article Link 3

Title of Talk: Climate-related Tipping Points and their Finance Implications

Tipping points in climate science normally refer to small changes in the Earth system that unleash much broader, typically damaging impacts that accelerate climate change. Well-known examples are rising sea levels due to disintegration of the Greenland and West Antarctica ice sheets, or the release of methane from the thawing permafrost. They help to underline the urgency of climate action. Today most people understand we must reduce emissions – and very quickly. In this webinar, Tim will summarise recent evidence regarding climate tipping points, which supports declarations that we are in a ‘climate emergency’. Then he will turn to identifying positive social tipping points that will need to be triggered to have any hope of limiting global warming to well below 2C. Professor Tim Lenton is one of the most renowned climate scientists in the world known for his famous work on “planetary boundaries”. He is a global authority on climate tipping.

Cornell-U.S. Treasury

Global Climate Finance & Risk Conference

To attend register here | Conference website here

Virtual, Friday October 25, 2024

I am co-organizing a Virtual Conference on “Global Climate Finance at Risk” on Friday October 25, 2024. This one-day conference will feature a blend of policy discussions and scholarly paper presentations focused on scaling climate finance to decarbonize the global economy. This is an especially salient topic in the context of globally rising emissions and a fast depleting carbon budget, and in the context of COP29 which will focus on setting a “New Quantified Goal” for Climate Finance. The conference sessions will cover the role of governments, investors, development institutions and macroprudential policymakers in unlocking climate finance at scale.

The conference brings together the world’s leading voices on this topic. Keynote speakers at our conference include the Janet Yellen (U.S. Treasury Secretary) and Mark Carney (GFANZ), as well as top climate scientist, Professor Johan Rockström (Potsdam Institute), Bob Litterman (Kepos Capital), and Eric Usher (UNEP-FI).

If you are interested in attending, please register!

Reducing Carbon Using Regulatory and Financial Market Tools

Monday, October 30, 2023

Register for the webinar here!

As co-organizer of the Young Scholar’s Webinar on Climate Finance (with Michael Barnett, Diego Kanzig, and Ishita Sen), I am excited to moderate the excellent paper entitled “Reducing Carbon using Regulatory and Financial Market Tools” by Adalina Barbalau. Adelina Barbalau is an Assistant Professor of Finance at the Alberta School of Business, University of Alberta. Her paper has received the Best Paper Award at EFA 2023. Her paper is significant in that it theoretically explores how carbon taxation and climate finance (sustainability-linked bonds) might be complementary and under what cases these might be equivalent. This study matters in a world of incomplete carbon taxation.

Recent Research

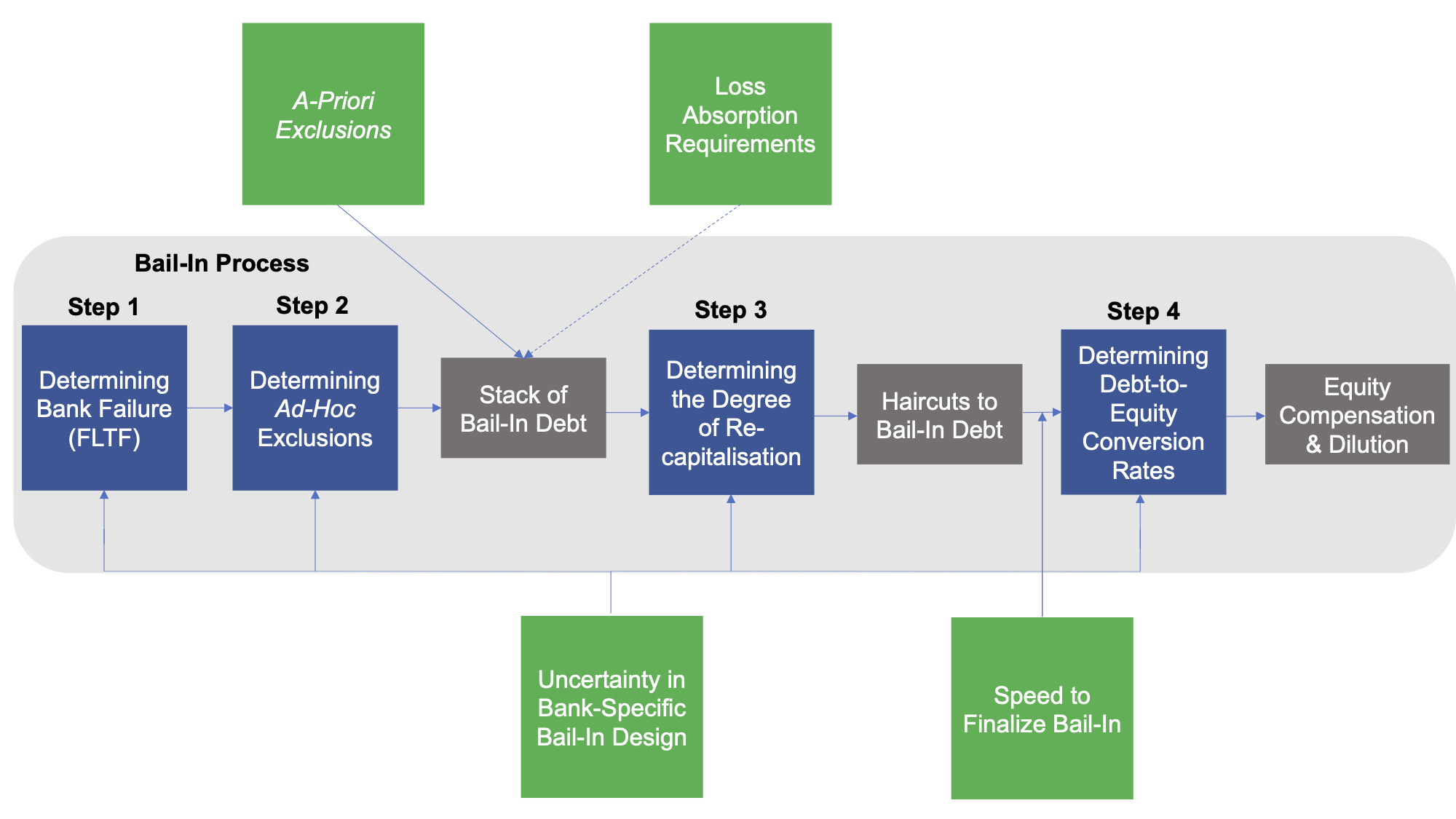

Resolving Too-Big-To-Fail: How the Bail-In Design Matters

Could bail-in resolve the too big to fail problem? To answer this, we study systemic implications of the bail-in design, capturing the financial system’s networked nature. Our hypothesis that bail-ins are not credible in systemic crises but are credible for idiosyncratic bank failure is partially rejected. We find that the credibility of bail-in hinges on the bail-in design. A well-designed bail-in maintains stability even in severe systemic crises, whereas an ill-designed one exacerbates distress, also when the largest banks fail idiosyncratically. The current bail-in design creates instability. While policy makers can fix this, the political economy incentives make this unlikely.

The Great Carbon Arbitrage

We measure the gains from phasing out coal as the average social cost of carbon times the quantity of avoided emissions. By comparing the present value of benefits from avoided emissions against the present value of costs of ending coal and replacing it with renewables, our conservative baseline estimate is that the world can realize a net gain of $85 trillion. This global net social benefit can be attained through an international agreement to phase out coal. We also explore how this net benefit is distributed across countries and find that most countries would benefit from a global coal phase-out even without any compensatory cross-country transfers. Finally, we estimate the size of public funds that must be committed under a blended finance arrangement to finance the cost of replacing coal with renewables.

Paper

CEPR Working Paper, IMF Working Paper

Website of paper: https://greatcarbonarbitrage.com

Media: Financial Times, Trouw (front page), Trouw (big read), NRC (big read), IMF Market Insights, Insights ESG, Axios, Tagespiegel, Grist, Business Traffic, CEPR (special mention), and many more see.

Podcast: VoxEU

Blogs: VoxEU, VoxEU 2, SUERF, SIEPR Stanford University, IMFBlog, INET University of Oxford, Imperial College London

Presentations (a selection): Corporate Carbon Disclosures Conference, Stanford Graduate School of Business & Stanford Doerr School of Sustainability; Federal Reserve Board of Governors; Chief Economist Research Seminar Series, The World Bank Group*; 2022 YISF Annual Symposium: The Parallel Pressures of Sustainable Finance, Yale Center for Business and the Environment, Yale University; Finance and Environmental Sustainability Conference, Stanford Graduate School of Business & Stanford Doerr School of Sustainability; The Political Economy of Environmental Sustainability Conference, Stanford Graduate School of Business & Stanford Doerr School of Sustainability; Roundtable on Blended Concessional Finance in Climate Investing, King Philanthropies and the International Finance Corporation, King Center on Global Development, Stanford University; Workshop on Fiscal Policy and Climate Change, European Central Bank; Office of Financial Research Conference, Climate Risks & Financial Stability; Keynote, 2022 Cornell University ESG Investing Research Conference, Cornell University’s SC Johnson College of Business; Keynote, Sustainable Global Capital Conference*; Office of the Comptroller of the Currency; World Resources Institute; Climate Policy Initiative; Fidelity Investments; International Monetary Fund; Institute for New Economic Thinking at the Oxford Martin School; De Nederlandsche Bank; Universiteit van Amsterdam; Vrije Universiteit; African Development Bank, European Investment Bank, European Bank for Reconstruction and Development; Banque de France; Bundesbank; Asian Development Bank; Brookings Institution*; New York University; Imperial College London; Bruegel; 13th NYU-LawFin/SAFE - ESCP BS Law & Finance Conference; Bank of Italy; The E-Axis Forum on Climate Change, Macroeconomics and Finance; Climate Finance, Innovation & Challenges for Policy, Stanford Department of Economics & SITE, Stanford University; Caltech; Western Finance Association Meetings; BlackRock; COP28

Stress Testing the Financial Macrocosm

What should the next generation of financial stress tests look like? If recent crises are any guide, our strongly interlinked financial system, economy, and indeed wider society need to be viewed in unison – together, they make up a larger ‘financial macrocosm’. Studying the resilience of that larger macrocosm requires a new generation of stress testing models that capture the interconnections within the financial system, between the financial system and the real economy, and – particularly in the context of climate change – the interconnections between the natural world, the real economy, and the financial system.

Paper

Handbook of Financial Stress Testing (eds. Farmer, Kleinnijenhuis, Schuermann & Wetzer)